Every day we help individuals & small businesses juggle their finances.

Take the stress out of tax

Frank Tax Consulting will help take the worry out of running your business by offering guidance and assistance on all forms of tax and business advice. We listen to our clients, ask the right questions to gain an understanding of your business and individual goals, before offering practical recommendations to help you and your business prosper.

We speak your language

We have over 15 years of experience and all our team members are multilingual, we speak your language, English, Mandarin, Cantonese and Teochew dialect.

Taxation

- Income Tax Returns for individual, partnership, company, trust, SMSF

- Tax Planning & Structuring

- Statutory returns, GST, BAS, IAS, PAYG Statements

- Capital Gains Tax, Small Business concessions

- Fringe Benefits Tax

- Land Tax registration and variation

- Payroll Tax & Workers Compensation renewal

- Superannuation clearing house setup and reporting

- Single Touch Payroll setup and advisory

- Late and multiple year tax returns

- Tax file number application for individual living outside of Australia

Accounting

- Maintenance of accounting books & records

- Preparation – interim & annual accounts

- Preparation of management reports

- Budgeting & cash flow analysis

Superannuation Funds

- Fund administration

- Preparation – annual accounts & tax returns

- Liaise with fund auditors

Corporate Secretarial Services

- Set up & maintenance of Trusts

- Meet statutory obligations

- Report and minute keeping service

Trusts

- Company formation

- Maintenance – company statutory records and company searches

- Preparation & lodgment of ASIC forms

- Act as Registered Office

- Preparation of company minutes

- Business names reserve and registration

Frank Tax Consulting is a CPA Practice & a Registered Tax Agent.

We are a local public accountancy practice locate in the heart of Hurstville, Southern Sydney, we were established in the 2012 year and have been servicing local and other business from all over Sydney. Our growth has been from positive word of mouth and business referrals. We specialise in servicing the needs of individuals and micro and small to medium size businesses.

Frank Tax Consulting offers services to all entity types including:

- Individuals

- Sole Traders

- Partnerships

- Companies

- Trusts

- Self-Managed-Superannuation Funds

- Non-for-profits and associations

We aim to provide our clients with a highly personalised service which is cost-effective, efficient and superior to that of our competitors.

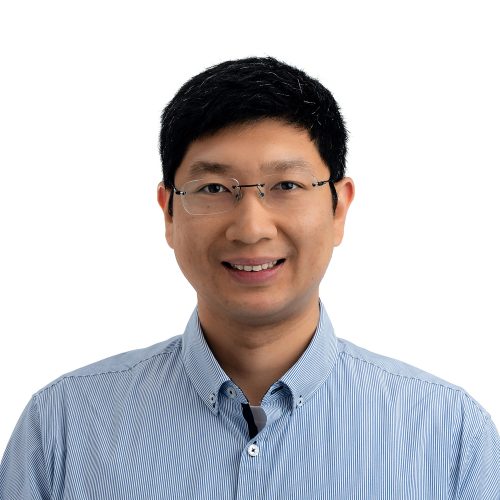

Meet our team.

We have a diverse team of multilingual professionals who are dedicated to making your finances a breeze.

CPA, CTA, Tax Agent, JP

Frank is a qualified Certified Practising Accountant with more than 15 years of experience, having studied bachelor of commerce (accounting) and graduated from university of NSW in 2005, Frank learned his skills and experience with a local CA/CPA practice in Surry Hills for over 8 years, gaining valuable technical experience and the day to day operation of a public accountancy practice, and the process of dealing and solving client’s issues, in 2012, Frank move on to setup Frank Tax Consulting as a sole practitioner and has grown his practice from there on.

Frank’s friendly, open persona and candid communication style, coupled with his broad based industry experience and up-to-date technical expertise enable him to decipher complicated tax jargon into plain English.

Frank is a member of the Certified Practising Accountant (CPA), a member of the Taxation Institute (CTA), a Registered Tax Agent and a Justice of the Peace.

Frank is fluent in English, Mandarin, Cantonese and Teochew Dialect.

Bachelor of Commerce – UTS, CPA

Yu has been working for Frank Tax Consulting since 2017 and is from Guangxi, China. Yu is a member of CPA Australia, prior to joining FTC, Yu has worked in other CPA Practice for more than 5 years. Yu is keen to assist clients in keeping up with their compliance obligations and to get the best taxation results for them.

Yu has extensive experience in providing accounting & taxation services to small businesses, he’s area of focus is in the business financial report and tax return preparations, including company, trust, SMSF and non-for profit association. Yu is a valuable team member.

Master of Accounting – UOW

Sharon completes her Master of Accounting degree in 2007 and has work in the accounting industry since then, she previously worked in the travel industry as an accountant has gained valuable experience in the management accounting space. She joined Frank Tax Consulting in 2014 and has been managing the day to day operation of the practice, Sharon is responsible for client engagement and other government authority contacts. In addition to her office duties, she focus in the field of tax preparation for individuals and property investors, she also assist in client dealing with land tax matters, including registration, variation and foreign person duty surcharge issues.

Certificate IV in accounting – TAFE

Karen completed her certificate IV studies in Australia prior to joing Frank Tax Consulting in 2015. Karen specialised in business bookkeeping for a range of industries, including café, restaurants, tradies, IT & Consulting etc. Karen’s approach to record keeping and proficient use of Xero/quickbooks online makes the bookkeeping process effortless for clients.

Karen works partime (three days a week) in our practice and she teaches Piano lessons when she is off work.